[/one_third_last]

[/one_third_last] [gradient_divider]

Transactional ROI:

Determination of ROI is based on some key points:

- How many calls do I need to make a sale? (A)

- How much is my average sale? (B)

- How much of the average sale is profit ((FROM QUESTION 2) MINUS OVERHEAD, PRODUCT COSTS, ETC)? (C)

- How much did I spend on the advertisement to get that customer? (D)

- How many calls did that ad generate? (E)

Now the ROI calculation:

- We take total calls generated by ad (E) and divide the conversion rate (A) to get a customer count

- Take the customer count and multiply it by the profit per sale(C) to get our total profit off said advertisement.

- Now the final step. total profit divided by Total cost of advertisement = ROI

Example 1:

- I convert 6 out of 10 calls

- My average sale is $60

- My profit per sale is $24

- I spent $450 on yellow pages this month

- It generated 90 calls this month

- 90/6= 15

- 15X24=$260

- 260/450=.577

- ROI = .577:1 (this is a losing ROI)[/one_half] [one_half_last]

Example 2:

- I convert 6 out of 10 calls

- My average sale is $80

- My profit per sale is $40

- I spent $600 on my online ad this month

- It generated 160 calls this month

- 160/6=27

- 27X40=$1080

- 1080/600=1.8

- ROI = 1.8:1 (this is a winning ROI)[/one_half_last]

We need to make more money then we spent on the advertisement, in example 1 we lost money and should put some serious though into why we advertise in that format, in example 2 we made $1.80 for every dollar we spent. Most businesses expect at least a 2:1 ROI but some business are ok breaking even at a 1:1 ROI.

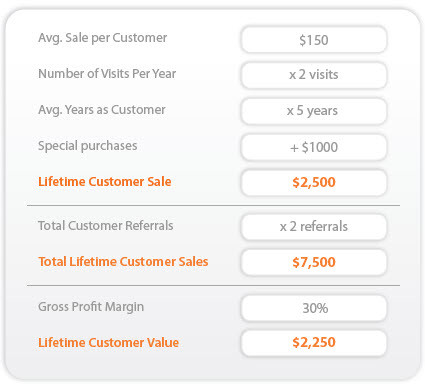

[gradient_divider]Lifetime Customer ROI Calculation:

Most industry experts agree that it costs five times more to acquire a new customer than to retain an existing one (Harvard Business Review). So, when thinking about how much a potential customer is worth to you, it’s important to look beyond the initial transaction and estimate the total value that customer can potentially bring to your business over time. With this information, you can better decide which forms of marketing you want to execute to acquire new customers.

We are going to use the same questions from the Transactional ROI above but look at the customer value in a different way.

[one_half]Each new satis ed customer should result in:- Initial Sale, e.g. a customer visits your veterinarian clinic for a routine pet exam

- Repeat business, e.g., the customer returns for a second check-up or shots

- Up-sell, e.g., the customer purchases flea medicine after a routine visit

- Special purchase, e.g., the customer brings their pet in for a one-time teeth cleaning

- Referrals or word of mouth, e.g., the customer tells a neighbor with two pets about your clinic[/one_half] [one_half_last]

[/one_half_last]

Now the Calculation:

[one_half]- I convert 6 out of 10 calls

- My average sale is $60

- My average customer value is $2,250

- I spent $1450 on my yellow pages ad this month

- It generated 90 calls this month

- 90/6= 15

- 15 X $2250=$33,750

- $33,750/$1,450=23.27

- ROI = 23:1 (this is a major ROI)

You can see the major difference in the two different calculations. With this data at your fingertips, you can select the right marketing mix for your budget and drive more return on your investment.

[gradient_divider]If you have questions calculating your ROI, please call Chris Kligora at 720.427.3707, he would be happy to explain ROI for your business in contrast to your marketing efforts.